In the modern financial landscape, Automated Clearing House (ACH) direct deposits stand as a crucial mechanism, providing convenience, speed, and efficiency in processing financial transactions. Despite its widespread use, many are unfamiliar with the intricacies of this system. This article aims to unravel the complexities surrounding ACH direct deposit, outlining its functionality, benefits, and operational protocol.

ACH direct deposit is a payment system that transfers funds electronically between banks and credit unions. Institutions leverage this method for various types of transactions, such as salary payments, government benefits, and tax refunds. This process ensures that funds are transferred securely and promptly, ensuring that recipients have access to their funds without the need for physical checks.

The ACH Network

The ACH Network is a centralized system that coordinates electronic funds transfers between various financial institutions. It processes large volumes of credit and debit transactions in batches and is regulated by the National Automated Clearing House Association (nacha file) and supervised by the Federal Reserve.

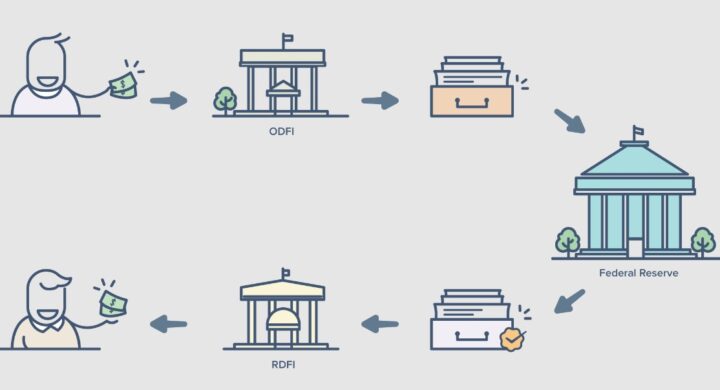

The participants in the ACH Network include the Originating Depository Financial Institution (ODFI), the Receiving Depository Financial Institution (RDFI), and the ACH Operator.

How ACH Direct Deposit Works

To begin using ACH direct deposit, individuals must first provide their bank account and routing numbers to the entity from which they will be receiving funds. The payer’s bank, the ODFI, will then send the payment information through the ACH Network.

Upon receipt of payment information, the ACH Operator sorts and sends the transaction data to the recipient’s bank, the RDFI. The RDFI then deposits the funds into the recipient’s account, completing the transaction. This process typically takes 1-3 business days.

Benefits of ACH Direct Deposit

Convenience

One of the most significant advantages of ACH direct deposit is convenience. Eliminating the need for paper checks streamlines the payment process for both payers and payees.

Efficiency

ACH direct deposit is highly efficient, allowing for the quick and seamless transfer of funds, reducing the wait time for access to money.

Security

By minimizing the handling of physical checks, ACH direct deposit enhances the security of financial transactions, reducing the risk of fraud and theft.

Challenges and Considerations

While the ACH direct deposit process is generally reliable, errors such as incorrect account information can cause delays and complications.

Timing

Due to the batch processing nature of the ACH Network, it’s essential for entities to plan their transactions, ensuring timely processing and access to funds.

In conclusion, ACH direct deposit stands as an essential tool in the contemporary financial ecosystem, offering convenience, efficiency, and security in processing transactions. Understanding its workings, benefits, and potential challenges allows individuals and institutions to navigate the financial landscape more effectively, ensuring smooth and reliable money transfer processes.

FAQs

What Information is Needed to Set Up ACH Direct Deposit?

To set up ACH direct deposit, individuals typically need to provide the following:

- Bank account number

- Bank routing number

- Type of account (checking or savings)

- Name and address of the bank

How Long Does an ACH Direct Deposit Take?

An ACH direct deposit usually takes 1 to 3 business days to complete. This time frame can be affected by various factors, including the time of transaction initiation and the processing schedules of the involved financial institutions.

Is ACH Direct Deposit Secure?

Yes, ACH direct deposit is considered to be a secure method of transferring funds. The process is regulated by NACHA and supervised by the Federal Reserve, ensuring adherence to strict security standards and protocols.

Additional Resources

For those seeking further information on ACH direct deposit, a variety of resources are available:

- National Automated Clearing House Association (NACHA) website ─ NACHA oversees the ACH Network, ensuring it operates efficiently and securely. Their website offers extensive information and resources related to ACH direct deposit.

- Federal reserve website ─ As the supervisor of the ACH Network, the Federal Reserve’s website provides resources and information regarding ACH direct deposit and other electronic funds transfer systems.

- Financial institutions ─ Many banks and credit unions offer detailed information and assistance related to ACH direct deposit, helping customers to understand and effectively use this payment system.

Case Study ─ Implementing ACH Direct Deposit

To further illuminate the practical aspects of ACH direct deposit, consider a case study involving a small business opting to employ this method for salary payments. Initially encountering challenges with timely and secure payments using traditional checks, the business sought a more efficient and reliable system.

Upon implementing ACH direct deposit, they were able to streamline the payment process significantly. Employees now consistently receive payments in their bank accounts on time, enhancing overall satisfaction and reducing administrative burden. The transition also heightened the security of transactions, minimizing the risk of check fraud and theft, and reinforcing the company’s commitment to safeguarding their employees’ financial transactions. The case highlights the tangible benefits of ACH direct deposit, emphasizing its impact on enhancing operational efficiency and security.

Final Thoughts

In the rapidly evolving world of finance, ACH direct deposit stands out as a pivotal tool, expediting transactions and ensuring the secure and efficient transfer of funds. By demystifying this payment system, individuals and organizations can better harness its capabilities, promoting seamless and reliable financial operations.

From understanding the initial setup to navigating potential challenges, comprehensive knowledge of the ACH direct deposit process empowers individuals and entities to make informed financial decisions and optimize their transaction processes. Embracing the convenience and efficiency of ACH direct deposit, users can enjoy a streamlined, secure, and modern approach to managing financial transactions.

Though the ACH direct deposit system may seem daunting initially, demystifying its processes and mechanics reveals a user-friendly, secure, and invaluable tool for modern financial management and transactions. As technology continues to advance, embracing and understanding these electronic systems is not only beneficial but essential for efficient financial management in the contemporary world.

As we wrap up this extensive look into the ACH direct deposit process, it’s imperative to continue staying informed and up to date about this essential financial system, ensuring you are utilizing it to its fullest potential for all your transaction needs.

While the article above provides a detailed overview of ACH direct deposit in under 500 words, a more comprehensive article should include further information on each section, real-life examples, quotes from financial experts, and graphics or diagrams to help explain the process visually.